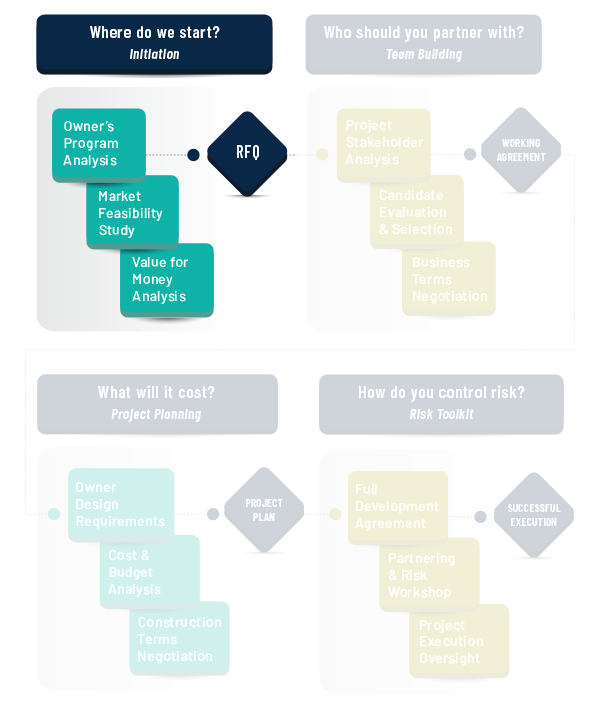

It is important to begin the P3 delivery process with a clear view of the end goal. What do you want to build and why should you build it? How will the end-user and the multiple stakeholder groups interact with the built environment after completion? What features are critical to the performance of the investment? What features are desired, but not critical? Answering these types of questions in a methodical fashion will equip the project team with the tools necessary to evaluate the project as well as effectively communicate the goals and desires of the owner to the private partners and project delivery team.

During this step, the owner assesses the practicality of the proposed project. An important first step is establishing how the private sector might fit into the team. Are there income streams or other financial benefits identified that would attract a private partner? The feasibility study will gather multiple data points related to market conditions and investor expectations. These data points can then become part of a financial model developed to gain a high-level understanding of the opportunity from the private perspective. A public-private delivery can only work in projects where there is a source of revenue and an opportunity for mutual benefit. Establishing these factors early in the process is an important step.

After understanding the owners’ goals and the private-sector opportunity, the project team must evaluate the impact of using a public-private delivery method. Will the owner achieve significant gain using this alternate delivery route, or would a more traditional delivery method be more appropriate? The value for money analysis involves both qualitative and quantitative analysis of the project as defined by the previous work. Qualitative analysis involves exploring the key differences between different methods and the policy considerations involved. Quantitative analysis involves conceptual estimates of both construction cost and operating costs, finance costs, and projected revenues if any. These estimates will be used to model the project using the identified options while adjusting for risk in each scenario. The comparison will summarize the key benefits and differences between the options for decision-makers.